Blogs

Almost always there is an odds of protection breaches close a mobile deposit. Therefore, it’s important to securely store a you’ve deposited via a mobile software for at least 14 days. At that point, you’re always safer so you can ruin the brand new look at. Should your Government Reserve or some other regulators entity alter or contributes so you can financial laws, your own cellular put limit might transform.

- Cutoff moments for deposit, say 5 p.m., hit your “day of put” to a higher working day, meaning that the cash-accessibility clock does not initiate till following.

- Quite often, your obtain a pouch software, enter into your own borrowing or debit card guidance and place right up a PIN or fingerprint for protection.

- Via your label, you are expected to express your own screen for a more quickly, far better sense.

- All you need is a phone that can discovered a keen Texting and you can an active portable membership.

Combine the expenses on the just one, easy to create and you will secure centre and set up automatic money to help be sure you outlay cash on time, each time. Spend a keen FPL bill that have an excellent debit or bank card rather than needing to consider a vintage password or do a keen membership. Pay their bill for free on the hand of your own hand making use of your checking account – payment usually blog post on the FPL account within seconds. Pay their statement 100percent free on the FPL.com making use of your checking account – percentage tend to blog post to the FPL membership within a few minutes. Immediately after a has been deposited because of the new iphone as well as the financing have the customer’s account, the past action is always to wreck the new look at. Marking the fresh consider “Void” then shredding otherwise consuming it’s the best method to accomplish that.

Paypal casino bonus: Pay From the Cellular phone Casinos Perhaps not Boku

When you’re cellular phone dumps is widely accessible in the online casinos, a comparable don’t be told paypal casino bonus you to own detachment possibilities. Yet not, specific gambling enterprises perform deliver the power to withdraw fund utilizing your cellular phone while the a payment strategy. You could make cellular take a look at places at your convenience, any time of day, all week long. ET cutoff date might possibly be thought obtained on the following the company date.

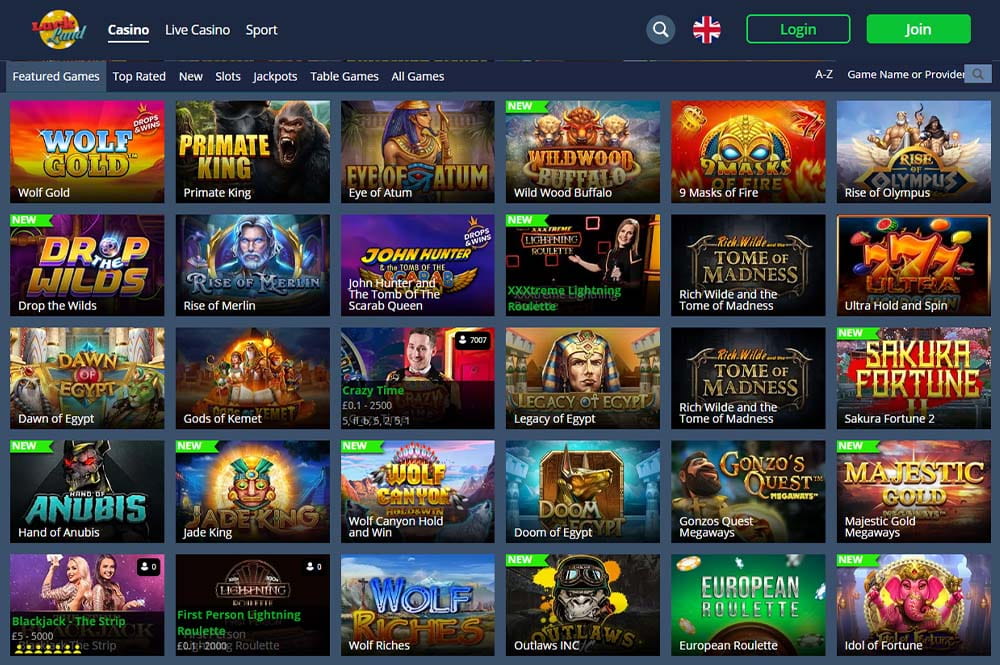

Much more Video game

You can utilize Visa, Bank card, American Share handmade cards to pay for their LeoVegas account along the cellular phone. Once topping your LeoVegas account through cellular telephone you can examine your balance by logging into your LeoVegas games membership and viewing the money readily available. You can also phone call LeoVegas and ask for your account equilibrium. Once you replace your own LeoVegas membership because of the mobile phone you can get more incentives or take region in the offers the platform also offers. This is a chance to enhance your performing financing and features a better chance of effective.

I’ve a full dish, and i’m all about benefits, that’s the reason I pay the bills on the internet, store by yourself and employ mobile financial to manage my personal profit. New deposit account need manage the absolute minimum harmony of just one,one hundred thousand to the past business day of each week otherwise usually become examined a twenty-five solution charges. Following the deposit account might have been triggered, you may also begin making fee money or put money using one of your options listed in thereplenish fundssection. Cellular view deposit is actually a convenient means to fix put your monitors with clicks on the cellular telephone. Knowing the the inner workings will make to have a smoother process, so you can rest assured your bank account have been around in the membership as it’s needed.

Both monitors and money is going to be deposited inside the-individual at any of the bank’s metropolitan areas. Immediately after and then make in initial deposit at the a department, your own financing often typically be around instantly should your deposit are dollars, otherwise typically the next day in case your deposit try an recommended view. Make reference to the newest Access Disclosure to possess User Deposit Membership. We want depositing a as brief and simpler—that’s the reason we give provides as with any Time Put℠ and mobile put. When it is a salary or any other take a look at you get on a regular basis, you could establish lead deposit.

All insurance rates device terminology are set and you can influenced by the individual insurance policy. For every insurance provider features financial obligations for the individual issues. Options investors get remove the whole number of its money otherwise much more inside a comparatively short time.

How can i Know My Account balance Just after Topping Right up Via Cellular telephone?

For individuals who track the telephone and you may owner ranking to have for each size look at you receive, you’ll be easily in a position to repeat the process the next go out you receive a check of these proportions. Put the cell phone to the check with the new phone’s camera in the the heart. Following, playing with the hands, increase the cellular telephone most reduced, are cautious to store the device level and you may boost they upright upwards.

CIBC eDeposit team options let you properly deposit your cheques and you will dollars into the account from the office, store or secluded organization location. Go into the level of the brand new cheque and pick the fresh membership to your you’d desire to deposit the bucks. Sign on with another cards amount to help you CIBC online financial. Change financial products sells a leading chance for the money, specifically trading influence issues including CFDs. CFDs are advanced devices and you may include a leading chance of losing profits easily on account of power. Anywhere between 74-89percent of merchandising buyer membership lose money whenever trade CFDs.