Settling loans can feel instance a daunting complications, however with a medical techniques in position and right systems at your disposal, you are free of financial obligation prior to when you expect-despite a low income.

Should your money possess sustained has just, or your money is certainly not extending how it accustomed now that rates is rising, you can nevertheless reduce enough time it will take to repay your debt.

step one, Evaluate the money you owe

First, get the full image of what you owe. Collect your financial comments (playing cards, car finance, etcetera.) and work out an email list with the following points:

- How much you borrowed for the loans, high bills (i.e., medical), and you may credit cards

- The degree of attract you’re purchasing

- Your own annual percentage rate

- Your own minimum monthly obligations

Once you know the fresh scope of the loans, you might put some reachable specifications. Including, you could performs for the shrinking the debt and you may preserving a whole lot more getting advancing years in this a few years.

2. Select more funds in your finances

Possibly extreme decrease have been in order, at least for some time. The goal is to scale back on any elective expenditures-eg dining, streaming memberships, response shopping, and maybe automobile ownership.

Very first, carry out an in depth budget and you can agree to record everything spend, in order to look for just how much you have to pay earliest costs. Life style within your function is essential, and it is easier to manage after you know precisely in which your bank account goes.

An important was in search of a strategy you might stay glued to, says Matt Lattman, vice-president off Find Unsecured loans. As viewing proceeded advances and only to make certain that you will be looking at your role several times a day is the greatest assurance i possess towards in order that you are on the way into the economic health.

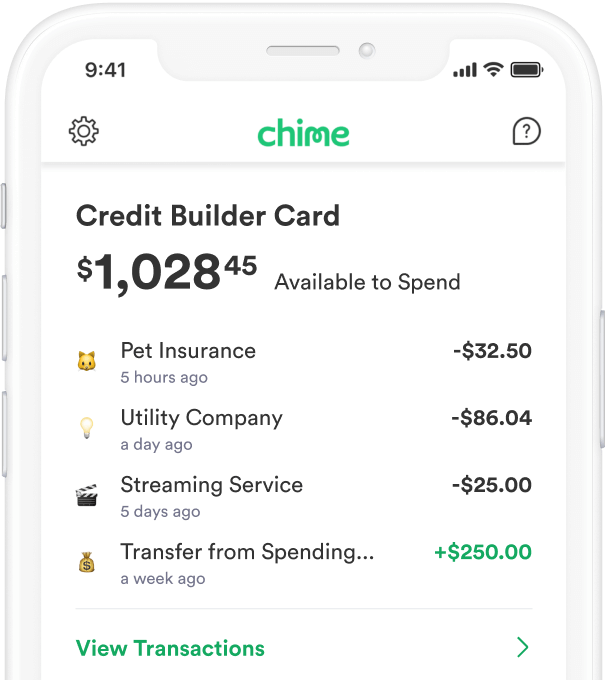

Second, think about automating your bank account. Such, automatically booked statement money and you can direct dumps from your workplace with the a savings account are fantastic an approach to remain on ideal from debt requirements. Not since money in to your bank account causes it to be simple to avoid expenses it to your other things, and there might even become a family savings that pay you significantly more inside attract than you’re going to get now.

Obviously, creating additional money, and you may boosting your financial obligation costs could help, also. In the event that a part jobs isn’t really throughout the cards, you happen to be capable earn extra money of the offering factors you no longer need, sometimes on line or in the a garage product sales. For those who have some thing you’re willing to part with, and you are clearly open to dismiss prices, you can can be found in some cash in the place of too much effort.

step three. Continue paying down the debt

One loans you can press out of your finances shall be place for the your debt. When you have credit debt, pay at the least the minimum commission on the your stability. And you will anytime you can pay more minimal, exercise. You can easily slow down the overall amount you only pay during the attention.

The mark, definitely, is to try to end carrying people rotating credit card debt. As much as possible repay the charge card equilibrium entirely per month through to the due date, you can easily end interest charge and charges.

In the meantime, be sure to avoid shed costs, that will damage their credit and you will allow you to be sustain a great deal more personal debt.

4. Keep yourself bad

It is possible to reduce financial obligation much faster for individuals who make sure to keep oneself accountable for the debt costs. It helps to create concrete work deadlines and payment quantity, or you could end neglecting about the subject if they are inconvenient.

Because you contemplate more financial obligation management steps, the original and most bottom line to do try sit and then make plans, claims Lattman.

A personal bank loan is a useful tool contained in this admiration, because it has a predetermined name with put monthly premiums. You will understand precisely whenever you’ll pay-off the borrowed funds for individuals who make all of your repayments on time. And you may, depending on your loan payment term and exactly how much you have to pay above the minimal percentage in your financing and every other loans, a personal loan may help reduce your debt burden sooner or later.

5. Discuss with financial institutions

Whenever you are going right on through difficulty, service providers (cellular telephone providers, utilities, etcetera.) was willing to give leases, such as for example lowering your payments otherwise stretching the commission words. So, do not be scared to ask.

If you are able to exercise a choice bundle, inquire to receive all the information in writing to be sure you understand what youre agreeing so you’re able to. And make sure you never miss one money.

6. Thought various other methods and you may units for paying down obligations:

- An unsecured loan for debt consolidation reduction you certainly will allow you to consolidate your debt and repay creditors truly. You might pay-off the mortgage with a predetermined monthly payment and interest rate.

- Debt settlement is when a 3rd-party providers stages in and negotiates a settlement together with your credit cards enterprises. Attempt to look into the debt settlement business, know very well what your liberties are once the a customer, and you will realize about the potential feeling to your credit history.

- Property equity mortgage may come having a diminished speed than you are expenses into the a leading-appeal credit card harmony, nonetheless it requires getting your property right up due to the fact equity in order to safe the borrowed funds. As the a property collateral financing otherwise dollars-out refinancing can be used for larger quantity, they could be an effective options whenever you are together with doing a massive venture such property introduction.

- A good 401(k) financing. Certain businesses assists you to borrow funds out of your 401(k) later years bundle. Be sure to weigh the huge benefits and you can drawbacks out of your own loan rather than an excellent 401(k) financing. There might be drawbacks such as for instance lost gains or losing an employer meets.

- Keep in touch with a cards specialist, who’ll evaluate your debts, help you talk about debt consolidating when you are out of work, otherwise highly recommend a method to pay off personal debt quick having a low earnings. The initial dialogue would be 100 % free, and that means you have absolutely nothing to lose out of an initial conference.

- Commemorate your achievement. Settling loans is difficult, and every submit action matters. Award oneself after you hit a great milestone, ing movie binge.

seven. Dont exercise alone

It can be difficult to chat openly regarding the items pertaining to money, however it can help faucet a close friend otherwise loved ones associate becoming your own responsibility companion on your own obligations rewards plan. They could make it easier to follow-up even more continuously and might and additionally become a supply of https://availableloan.net/personal-loans-or/oakland/ moral support.

So, build your credit card debt relief a residential district effort. And don’t forget in order to commemorate since you achieve your goals-a walk or coffees along with your liability mate could be just the new support you need to move on to your upcoming economic purpose.

With these debt consolidation calculator, you can observe the potential deals from consolidating higher desire loans which have financing away from Find. Imagine Deals