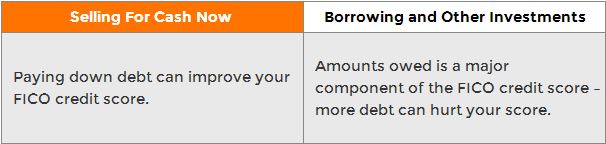

You’ll find tall differences between products in the marketplace. Be sure to check with your monetary advisers prior to making people big decision regarding the collateral you have accumulated in your home.

Lump sum

A lump sum payment household security financing really works like a frequent home loan the place you borrow a medication amount and also make the desired payments together with focus more than a certain period.

Generally, a lump sum domestic guarantee financing features a predetermined speed that is work on away from four so you’re able to fifteen years. Just be in a position to pay that it mortgage entirely one which just sell your residence.

Refinancing

Refinancing the most popular ways to accessibility the newest guarantee of your home. You may either re-finance together with your most recent lender (inner refinancing) or refinance with a new financial (exterior refinancing). Before you can re-finance, your home will need to be revalued to decide the current worthy of. If for example the assets features grown inside the really worth because you bought it, their lender can provide you the option of refinancing considering its the fresh new well worth, providing you with entry to the newest guarantee you’ve accumulated throughout your mortgage repayments.

It is critical to remember that while looking into the equity, you will need to spend you to definitely back at the particular stage, as well as notice.

Get across collateralisation

Get across collateralisation is the place you employ the fresh security you’ve gathered in one property to get other property. This is exactly a very risky habit because assets you currently own plus the property you will be to get both end up being safeguards to the loan. If you can’t result in the mortgage repayments, you could potentially might get rid of one another characteristics. You will need to mention you might just cross collateralise having one to bank.

Redraw facility

Whether your mortgage has a good redraw business you have access to the new collateral you’ve built up of the attracting upon they.

A beneficial redraw business lets consumers and also make most payments to their home loan, and withdraw (otherwise mark down’) on it after. Any additional payments you create which might be gathered on the redraw business try independent from your typical home loan repayments, that is the way they are available to withdraw.

Opposite financial

A face-to-face home loan is basically a variation regarding house guarantee mortgage. That it, however, might be set aside to own retirees whom individual one hundred% of the properties.

An opposite home loan gives you discharge part of your own property’s really worth, possibly as a lump sum or regular blast of income. Loan providers dont have a tendency to wanted month-to-month money for it type of financial, however they fees desire and expect your pay back a full matter for folks who promote the property, or in the situation out of retired people, if they move into aged care and attention or perish.

Simply how much security could you obtain?

More loan providers has other regulations precisely how far they are willing to provide to own domestic security finance. https://paydayloancolorado.net/vilas/ it will not suggest that just because you possess collateral collected, you will be able to gain access to a full amount.

Very lenders want you to hold at least 20% of the property’s well worth once the a variety of protection in your home loan. Should you want to make use of home’s equity yet still keeps an equilibrium in excess of 80% of property’s well worth, you’ll be able to be required to pay money for Lenders Mortgage Insurance (LMI).

Such as for example, if the residence is well worth $600,100 therefore the left equilibrium on the home loan was $250,100, then the guarantee you’ve got on the loan is $350,100. To find the level of obtainable guarantee, you need to discover the difference between 80% of your home’s worthy of and your outstanding balance.