Buying your first house is an enormous milestone-one that is sold with enough crucial choice-making and you may a giant economic obligation. As a result of this it is very important prepare before you can also search in the homes. One of several things that you should do when buying a home would be to make sure that you have your funds in check. Mortgage qualities are readily available and you may constantly consult which have a mortgage manager inside the Georgia to help you navigate the process.

Have no idea how to start? You will find waiting a simple listing that one may relate to while preparing to own a home pick:

step one. Look at the savings

Exactly how much you will need commonly mostly depend on the significance of the home you intend to get. Off https://elitecashadvance.com/personal-loans-oh/ontario/ repayments typically rates anywhere between ten and 20% of your home’s value.

It is very important for reasonable savings and a funds inside location for a home buy. If you don’t, its high time which will make a real plan which means you is also make cash and you can offers into the pick. The earlier you start controlling your finances when preparing to own a house purchase, the earlier you could start your own travel to the buying your first household.

step three. Look at your credit situation

A mortgage loan manager from inside the Georgia will look from the a number of products so you’re able to determine a suitable mortgage speed to you. This type of items often range from the amount of offers you may have and you can helps make readily available for a first percentage into the a house, possible threats into living otherwise revenue stream, as well as have significantly, your credit score. The point that the credit history was bashful out-of 800, you are going to pay a great deal more during the attention. To ensure your credit is ready to have property home loan, it pays to evaluate and you may overseeing your credit score, paying your debts (or no), and discovering out financial products, that may all the help you care for a good credit score.

Because of the examining your bank account, possible dictate how much you can afford to blow to your a mortgage loan. Home mortgage features can be extremely useful in choosing how you is also control your finances as you pursue a home pick. Other than your credit score, loan providers typically be the cause of other variables to choose your ability to pay off your home loan, just like your earnings, your own monthly costs, the lender statements, etcetera.

5. Do you have a location at heart?

Now you know the way much home you can afford, it is the right time to consider carefully your options regarding location therefore the brand of possessions you want to are now living in.

Generate a list of those things we wish to enjoys in the a unique family including the quantity of rooms, baths, driveway room, outdoor features, plus improvement possibilities including a basements which might be translated towards a house gym or perhaps a facility. These records can really well help you restrict your options.

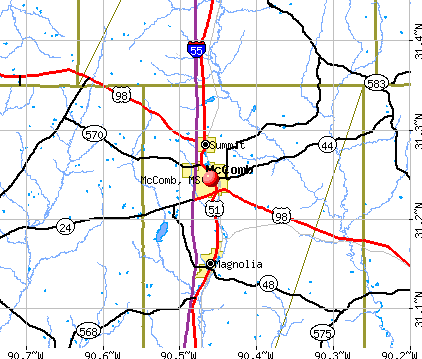

Regarding venue, think neighborhoods that are close to everything might need accessibility so you’re able to within a residential area. Research the cover while the general characteristics of your own encompassing city, eg its crime stats, the latest amenities available into the neighborhood, in addition to transportation links in and you will away from the area.

6pare cost

While looking for property, we wish to have the best bargain from your purchase. As a result of this its smart to try to get multiple fund so you might not have to be pinning your own expectations on an individual mortgage source. This may as well as give you the opportunities to examine cost and you will have the best package from the chosen bank.

About taking out home financing in your earliest house, it is important become open to a requiring loans. Queensborough Federal Lender can also be guide you so you’re able to a talented and you will educated home loan administrator for the Georgia who can assist you because of all of the the borrowed funds mortgage features the bank and you will faith company offers. The business considers they an effective privilege so that you can assist you with your residence pick because of different types of financing and you will home loan services they have on offer.