We have a credit score out-of five hundred. We very own a cellular household, it is fully covered. It is a beneficial 1963, however if pretty good contour. We paid bad credit personal loans Michigan 33,100 for it :but home of the identical year however, reduced products have marketed in the same community for 50,one hundred thousand ( this means I’m not sure of your genuine worth ). I’m today and then make regular payments for the student loan but I’m really far trailing toward mastercard.

A lot of time story brief the credit bank has open to assist me personally spend 50 % of the quantity to repay the fresh dept ( six,000 ) and that i will love 4000 to capture on car repairs, or other debts. I am looking ten,100000.

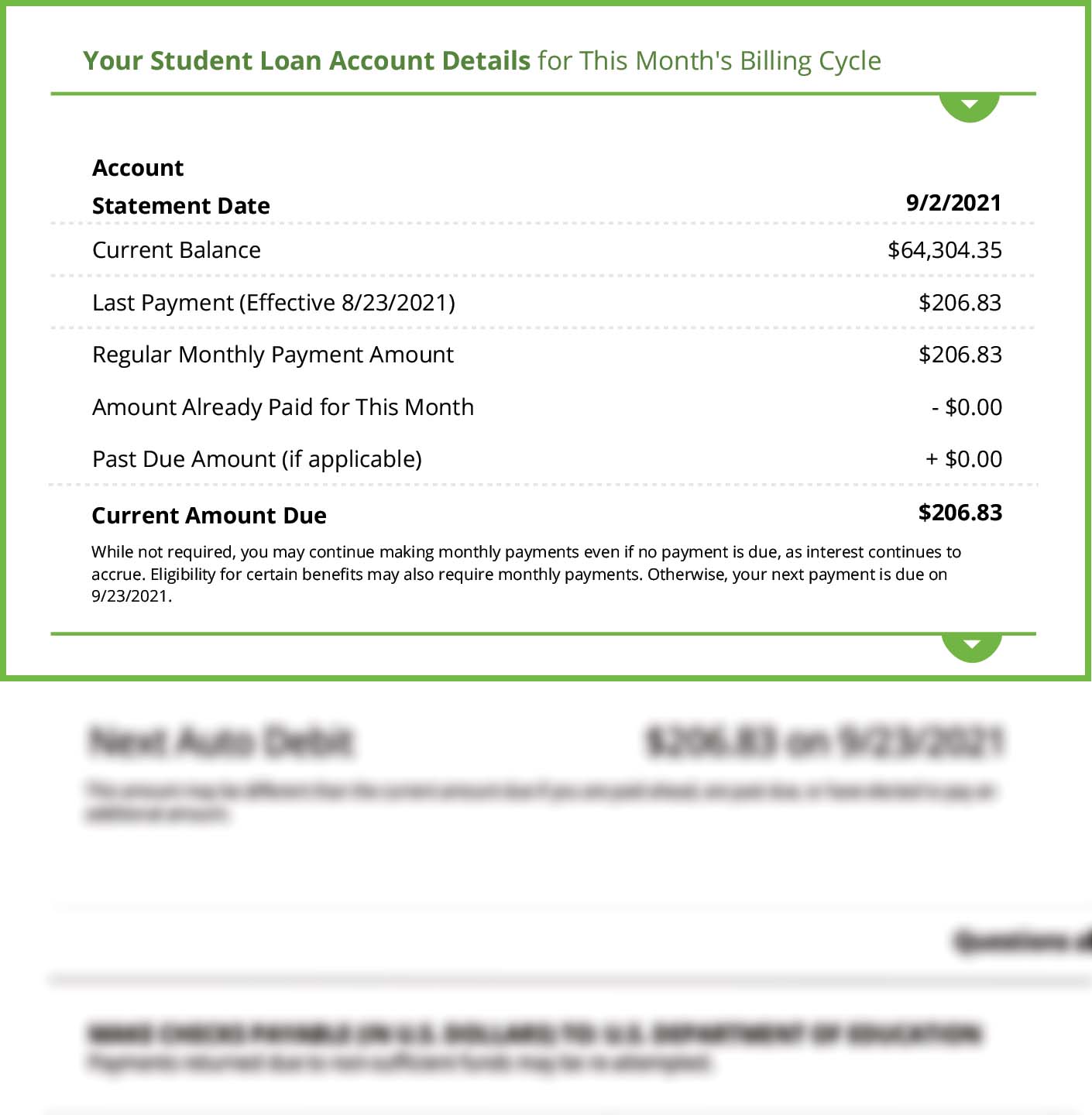

I’ve fallen trailing in my own student loan and you will bank card payments

How is it possible tp install it cellular house due to the fact equity and just have a secured financing using my credit score ? You will find a municipal solution job and i also were truth be told there for six ages, it is extremely secure and my income are 51,one hundred thousand. Many thanks for one recommendations that assist.

You can attempt American General to own a personal bank loan making use of the cellular house because guarantee. I am aware once upon a time Helpful and you can House Finance Corp. regularly take securtize signature loans against mobile home. You may have to pick a cellular household lender that may lien your own cellular family. There are lots of out there but they do require a higher credit score. I suggest you create several phone calls to cellular household lenders otherwise Western General observe where they’re able to lead you. All the best!

then you may go after property guarantee line of credit (heloc). fundamentally, heloc is a good choice to fulfill ongoing cash requires. this will allows you to mark money when you wanted, around a particular pre-computed limit. perhaps the desire you spend might be income tax-allowable.

the pace to own a beneficial heloc was initially below new usual household equity loan although rates you are going to vary according to the prime rate. as you have a minimal credit score, the rate accessible to your is a great nothing highest.

if you would like go for an unsecured loan, your mobile home would be managed just like the a personal assets and you can perhaps not use it as the a collateral. plus the interest levels of these financing is much higher than what you have made to own good heloc.

You should be in a position to pull out a loan inside just as you might providing you feel the title together with action, you will need to give-up this new identity since equity

discover lenders that happen to be happy to lend to the people that have less than perfect credit nevertheless may need to buy a little while to have loan providers to track down a reasonable price.

Make sure that all your fees and insurances are high tech, they’re going to browse that it prior to they give a loan.

When it is into a long-term basis you will get an excellent best speed, no way people moving it then.

You may have mentioned that the creditors are able to manage you. You could potentially keep in touch with her or him in regards to the choice. Whether your bank provides you with a debt relief, if so, your payments might be faster from the forty% so you can 60%. Thus you are going to need to shell out shorter in this case.

You are able to get debt consolidating system the spot where the lender wil dramatically reduce the interest levels to create it much easier on the best way to pay off the credit cards bills. In the event the bank offers one a couple of this type of preparations, I believe, it will better to choose for them instead of making use of the mobile family once the a collateral for the next home loan. You ought to request a monetary mentor just who could help so you’re able to make the best choice.