The brand new Canadian government only revealed the newest financial resource statutes aligned within permitting residents include additional suites on the features.

The aim is to assist ease particular pressure with the casing availableness by promoting “comfortable thickness” – playing with financial bonuses in order to prompt residents to cultivate additional construction systems on the assets. The advantage, depending on the government, is the fact incorporating a minumum of one financial helpers to your house provides earnings when it comes to rental money, in addition to secondary suites is to improve worth of the property.

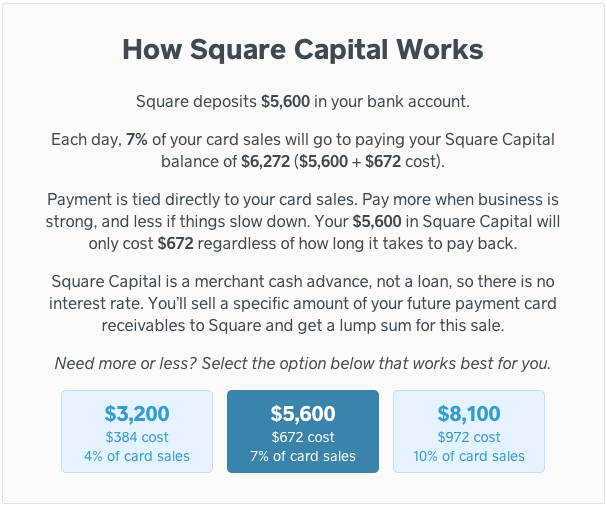

Arranged when planning on taking affect , the latest mortgage financing alternative enable people to refinance right up to 90% of its property’s well worth, along with any value-added when designing brand new leasing gadgets, such cellar accommodations otherwise laneway belongings.

If you find yourself you will find benefits to the new home loan system, there are even specific potential dangers; not only manage property owners have to make sure they truly are following conditions so you’re able to qualify for it money, plus be mindful of the opportunity of a lot of time-name damage to its complete monetary health.

Requirements of one’s the newest government supplementary suite funding system

So you can qualify for new refinancing mortgage unit, the latest resident otherwise a family member need reside the newest second room or some other unit inside dominant household; but not, the federal government has actually yet , in order to indicate exactly how which specifications was implemented.

Including, there’s all in all, four tools anticipate on possessions, and you may financial support with the upgrade of the home you should never go beyond the fresh new limitation worth of the home, that is capped on $dos billion.

Together with the restrictive criteria inside qualifying for it brand new resource, residents must read the possibility cons of accessing a giant part of the equity in their house. Particularly, listed below are 7 secret dangers as conscious of.

How much cash home do you manage?

Whether you’re looking for a different sort of house otherwise seeking to re-finance the financial, understanding how much your new financing may cost your is crucial. Fool around with our very own handy home loan calculator in order to know very well what your own repayments could appear to be.

Cannot Miss

- People are affected by higher home loan cost. Listed below are 4 loans for cosmetic surgery tips if you want to renew the financial inside the 2024

- Seeking to stash funds getting an advance payment on an effective domestic? Find a very good Earliest-Domestic Discounts (FHSA) Account to your requirements

- Have to crack their financial? You will be charged! Think about the advantages and disadvantages away from breaking your own mortgage

7 disadvantages of your secondary collection mortgage system to possess most recent home owners

Listed here are 7 warning flag you to definitely home owners should be aware of in relation to making use of the federal government’s the fresh new supplementary room resource system:

# step 1. Large focus will set you back

Whenever homeowners obtain a serious part of their residence collateral – whether or not compliment of a property collateral line of credit (HELOC), refinancing otherwise the secondary room refinancing system – loan providers can charge large rates of interest. Borrowing a lot more than 80% of the house’s worthy of can be regarded as a top exposure from the loan providers, which can result in costlier credit terms and conditions.

Because of the refinancing your house to gain access to significantly more equity, for example, youre obligated to deal with a top financing-to-worthy of home loan – also referred to as a covered financial. Covered mortgages wanted loan providers to get home loan default insurance policies – and therefore functions as defense would be to a borrower standard on the house loan. not, lenders scarcely take in the superior for it insurance and you may, rather, pass on so it pricing into the homeowner.

For example, if you decide to enjoy the federal government’s this new additional collection money program and you may and when their financial was up getting renewal on the gets in effect (and keep mathematics simple, eliminate charges billed getting cracking your own mortgage), then you might open to $step 1.8 billion in mortgage finance. At the newest average four-12 months fixed rates to possess an insured home loan (off 4.19%), you to definitely equates to home financing payment out-of simply more than $cuatro,825 per month.