A good dragnet clause is worded the following: the newest agreement is done and you can meant to payday loans Cherry Hills Village area safe the indebtedness today otherwise hereafter due because of the mortgagor to mortgagee. ” If a borrower removes a mortgage that have an excellent dragnet clause and you may she yields to the exact same bank after to obtain an unsecured loan, anything loaned included in the personal bank loan was pulled to the mortgage’s harmony.

A property manager who’s applied for home financing can sell their particular assets even though she continues to have multiple mortgage payments in order to generate. However, home financing agreement normally prevent the newest totally free transfer from property in the event the the underlying contract comes with a beneficial “owed for sale” clause.

It is risky to possess a loan provider to help you matter another financial as another home loan terminates should your debtor non-payments to your basic

Including a term usually apply at both a debtor and a loan provider in the event the a property owner would like to offer the house without repaid the complete mortgage. This condition allows the current bank to mention the entire financing due and you may payable if the resident transfers identity into the domestic without having to pay the mortgage in full.

not, it ought to be indexed one government laws, underneath the GarnSt. Germain Depository Organizations Work away from 1982, disallows the fresh enforcement from due-on-transfer conditions if the transmits are designed to specific close relatives.

If there is zero owed discounted term, mortgages are easily transferrable. A great transferable financial, referred to as a keen assumable financial, is a loan that one group normally move into a separate. The financial institution sets the borrowed funds regarding the transferee’s name; the transferee requires obligations getting cost under same interest rate and you can other words the initial debtor had.

Although the financial shall be transferred, their words determines subsequent purchaser’s possible liability into original borrower’s financial obligation. The primary conditions listed here are at the mercy of otherwise a presumption out of. Whether your possessions are going to be moved “at the mercy of” a home loan, the fresh holder cannot be stored truly responsible for the underlying loans. If for example the further proprietor of a good “at the mercy of” financial defaults, the lender is also foreclose on the property might be foreclosed but the new lander dont sue your for any left matter owed into the debt immediately after public sale. As an alternative, the lender can also be get well people left damages regarding modern borrower.

On top of that, if your then manager regarding an assumption of financial defaults, she will get really accountable for settling your debt. The lending company is also foreclose and sell the home and you may sue one another the original borrower as well as the subsequent buyer for matter nevertheless owed to the assets.

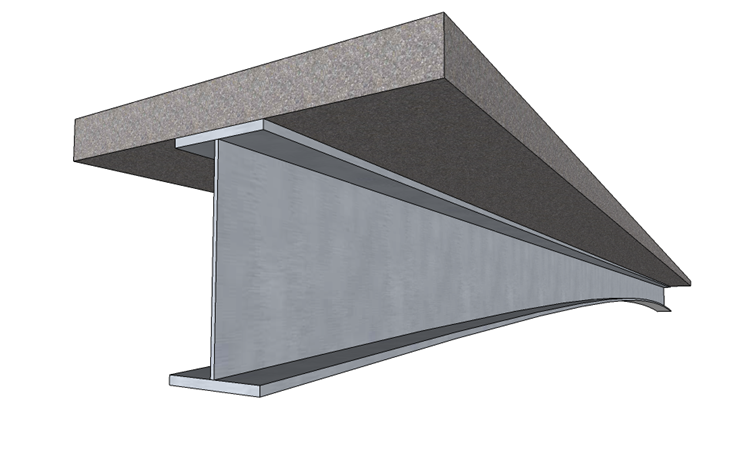

A debtor may want to sign up for an extra home loan for the their property. Except if the first financial agreement expressly forbids him regarding performing this, he can financial their property as often when he wants. All of the further mortgage try inferior compared to the last.

To help you decrease it exposure, new issuer regarding a second mortgage will desires estoppel permits requiring the original mortgage-holder to offer see out of an upcoming default and provide next mortgage-holder a chance to lose and you may prevent foreclosures.

Although not, foreclosure are an extreme remedy for default and you can an excellent defaulting borrower keeps contractual and you will due process liberties ahead of a lender will start foreclosure

If a debtor fails build home loan repayments promptly, the financial institution has numerous choice. Property foreclosure is among the most extensively-acknowledged effects having not paying home financing whenever owed.

When you look at the a foreclosures purchases, home financing proprietor will sell the actual house familiar with safe the mortgage and use this new proceeds to fulfill the mortgage personal debt. If a foreclosures product sales contributes to a sale speed over the loan loans kept, the borrower is actually eligible to the other matter.