They pleasure themselves to the knowing how its mother or father organizations construction timelines work which means that your household (and) loan stay on plan.

It means you are able to get your hands on a low financial rate you to external lenders just cannot beat.

Keep reading more resources for them to know if they might possibly be a great fit to suit your mortgage requires.

Motivate Home loans Offers Huge Speed Buydowns

- Direct-to-consumer lending company

- Also provides home purchase fund

- Situated inside the 2016, based in Newport Seashore, California

- An entirely possessed part out-of Century Communities

- Mother or father organization is publicly exchanged (NYSE: CCS)

- Licensed to give from inside the 18 states nationally

- Funded about $dos million home based money within the 2022

- Extremely effective into the Ca, Tx, Georgia, and Texas

- Together with operates a name business and you can insurance company

Encourage Lenders is actually a completely had subsidiary out of Century Teams, which offers so you’re able to-be-mainly based and you may small flow-in the home within the some states across the country.

Their number one notice is offering household get loans to people out of newly-mainly based home on of several organizations it efforts regarding country.

He could be authorized during the 18 says, also Alabama, Arizona, California, Tx, Florida, Georgia, Indiana, Louisiana, Kentucky, Michigan, Las vegas, North carolina, Kansas, Sc, Tennessee, Tx, Utah, and you may Washington.

Just like other builder-associated loan providers, Promote Home loans also operates a title insurance coverage and settlement team named Parkway Identity, and you may an insurance company titled IHL Home insurance Agency.

It indicates can be done you to-stop wanting all your valuable home loan demands, even if it certainly is prudent to shop around for these types of third-cluster characteristics too.

How to begin

You may either go to a beneficial Century Organizations new home conversion office discover paired with that loan manager, or simply just use the internet.

For folks who check out their site, you could potentially click on Pre-meet the requirements Today to gain access to a loan administrator directory that listing the countless groups run by their parent organization.

Just after seeking a state, possible select a residential district to see which mortgage officers serve that certain invention.

After that, you will observe contact information and you will probably manage to score pre-eligible to a home loan otherwise log on if you’ve currently used.

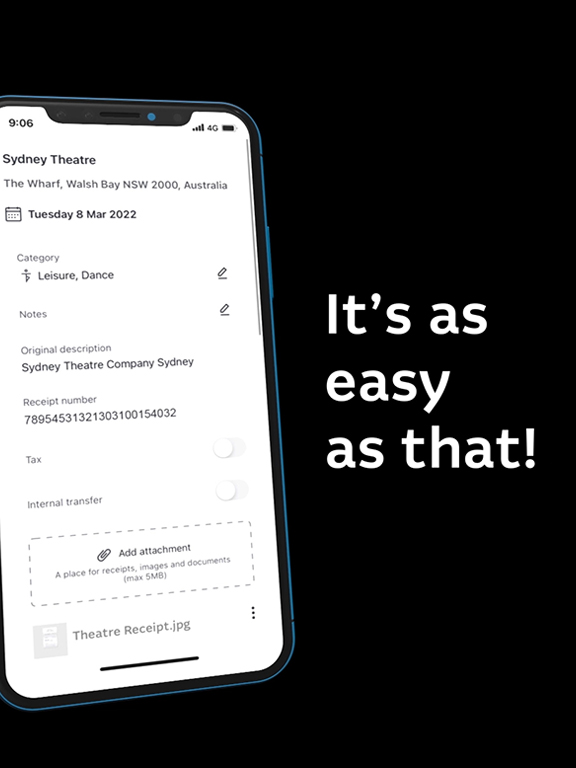

Its electronic loan application is powered by fintech business nCino. It allows you to definitely eSign disclosures, connect monetary profile, and you may complete the software out-of one equipment.

You may also lean on the faithful, individual mortgage group that’s available to aid and gives solutions once you keeps questions.

They look to give a great balance out-of one another technical and person reach to cause you to the finish range.

And because he is connected to the latest creator, they’ll be in a position to communicate easily and maintain your loan towards tune predicated on build standing.

Financing Applications Considering

When it comes to mortgage alternatives, they usually have most of the biggest loan programs property customer you’ll you prefer, plus compliant loans, jumbo financing, and also the complete array of authorities-supported financing.

The brand new Ascent Bar

This might are understanding how to help save to possess an advance payment, how to attract investment supplies, how to boost credit scores, as well as alter your DTI ratio.

And whether you’re a primary-go out household visitors or veteran, it carry out totally free webinars to respond to one home loan concerns you may want to has actually.

Inspire Lenders Cost and you may Costs

They will not listing their financial cost or lender fees on the internet, and that isn’t really atypical. However, I do render lenders kudos when they do. Its a bonus of a transparency viewpoint.

So we do not know exactly how aggressive he is prior to most other loan providers, neither can we determine if it fees financing origination commission, underwriting and you can running charge, app commission, etc.

Make sure to ask for all costs after you very first talk about mortgage costs with an interest rate manager.

When you are getting a rate offer, that along with the bank costs makes up your mortgage Apr, which is a definitely better solution to examine financing will set you back out of financial to help you financial.

One example offered a 2/step 1 buydown to 3.5% towards the first 12 months, cuatro.5% in the season two, and you may 5.5% repaired into left 28 years.

That is rather tough to beat whenever mortgage rates are alongside seven.5 today%. This can be one of the several benefits of making use of the builder’s home loan company.

However, as always, take the time to store the rate along with other loan providers, borrowing from the bank unions, mortgage brokers, and stuff like that.

Promote Lenders Product reviews

Yet not, they have a 1.8/5 toward Yelp from around 30 product reviews, although decide to try dimensions are definitely slightly short. On Redfin he has a better cuatro.4/5 away from 7 reviews, and this once again are a tiny sample.

You’ll be able to lookup its individual practices from the country to your Bing observe studies by the venue. This could be a great deal more beneficial if you use a particular local place of work.

Its parent organization have a keen A+’ get into the Better business bureau (BBB) web site and contains come accredited because the 2015.

Regardless of the strong page level score, they’ve got a negative step one.05/5-star rating according to over 100 customers evaluations. This could have to do with their numerous complaints recorded more than the years.

Make sure to take time to sort through several of these to find out how of a lot pertain to its credit office in the place of their new home-building tool.

Definitely, it’s likely that when you are having fun with Promote Mortgage brokers to acquire a good mortgage, you might be as well as purchasing good Century Communities property.

In order to contribution anything up, Inspire Mortgage brokers has got the current technology, a selection of loan apps, and might render rates specials one exterior loan providers $1500 loan with poor credit in Fraser cannot compete with.

He’s particular mixed feedback, but primarily confident ones, even if their distance may vary based the person you focus on.

However, make sure to store third-people lenders, agents, banking companies, an such like. Along with other also provides in hand, you could potentially negotiate and you can potentially belongings a level top contract.