The last items to take on within condition is the fact you may be not planning to instantaneously receive the difference between forget the and you may the loan

You’ve got student loan obligations. No matter what political winds, for those who have college loans you owe that cash in order to someone until it is paid down or forgiven in your stead. Particular education loan forgiveness is even sensed a taxable feel, and it may nevertheless be a taxable enjoy in case it is forgiven because of the authorities. Delighted April 15! Forgiveness or perhaps not, education loan debt is considered the most a number of bills that end up being shopped available for a lower interest rate. If this have been me, I would personally make the sure thing of a reduced interest than simply bet you to Uncle sam seems abreast of my personal half dozen-profile salary that have financial solicitude.

You’ve got credit card debt, personal loans, car and truck loans, money you borrowed the bookmaker, etcetera. I do not believe I must discourse outlined from the as to why these are step 1) too many having highest-earnings advantages otherwise 2) very economically injudicious. Yeah, perhaps that vehicle note are half a year desire-free, however, unless you have the funds happy to hand toward dealer after you to definitely six months, you happen to be to tackle a sucker’s games.

Judicious Uses off Influence

Let’s go without for the moment talks regarding leveraged ETFs, possibilities, futures, and you may margin change and look at a sensible influence circumstance in the and this we all will find ourselves.

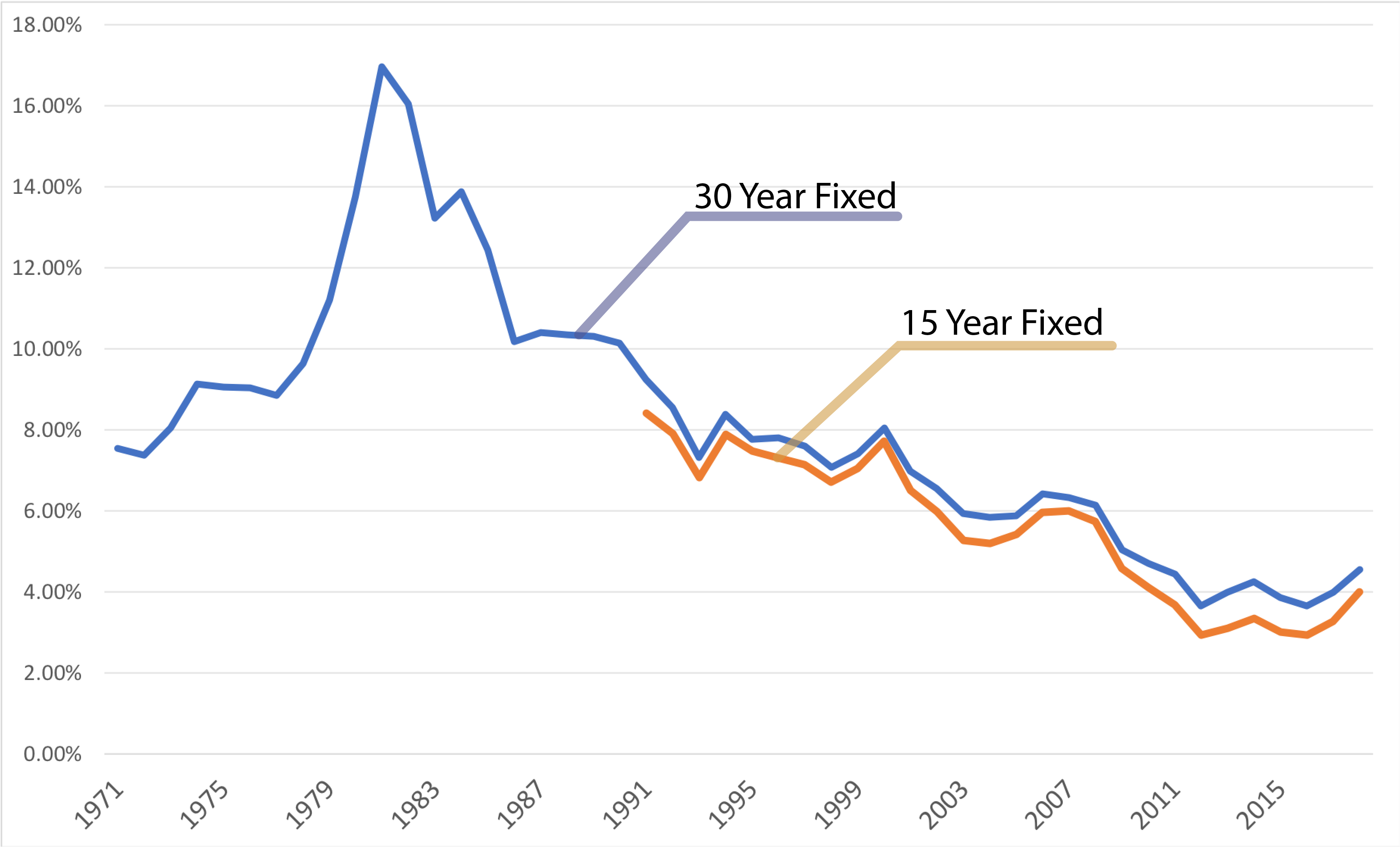

You’re 40 years dated and you will settled towards the a position that have a great companion and two children. Your new household, inexpensively acquired having the current joyous mortgage costs, is actually serviced because of the a home loan regarding $eight hundred,000. You and your spouse each other functions and you will contribute the maximum elective deferral of $19,five-hundred for every to possess, conveniently, $39,100 per year. Your currently keep a around three-day emergency finance (understanding that your disability insurance policy kicks when you look at the immediately following ninety days). Your lady, exactly who has been an enthusiastic reader of funding literary works, thinks you to definitely a lot of time-label guarantee productivity could be an affordable eight%, when you find yourself the financial is at step 3%. With your convenient future really worth calculator, your assess the cuatro% arbitrage (7% thought return off equities minus the step 3% you have to pay to be used of the bank’s currency through your home loan) out-of $39,one hundred thousand annually more than 30 years will be get back around $dos.dos billion.

The above mentioned analogy is a superb entry to power. Your guess (vow?) your industry have a tendency to come back more just what prices are out-of borrowing you to definitely matter. Chances are you are proper. There are a few caveats, yet not. You to undoubtedly small supply of rubbing would be the fact you’re now required to boost the degree of your own crisis financing and sustain new drag into bucks you need to continue. The extra matter totals to-be $cuatro,975 (mortgage repayment regarding $20, annually split because of the 12 months increased by the ninety days) stored inside the cash for another 3 decades. This should only amount to

The bigger care and attention is the fact that field may well not come back just what your thought it could. We have been the recipients of a very superlative bull markets over the last years, and field schedules are nevertheless a bona fide and provide chance. You are emotionally kicking your self if for example the second several years’ productivity browse meager. Tough however is a scenario where you have unanticipated expenditures significantly more than what is going to be included in their emergency loans. Sure, you can score a beneficial 401(k) mortgage, an effective HELOC, or a hard-currency loan; however, absolutely personal loans in Miami nothing to which you are able to get availableness will be as opposed to pricing.

If you find yourself investing during the 7% within the a retirement account being billed 3% attract, you’re probably maybe not accessing men and women seven% productivity to afford 3%. It means you happen to be bucks streaming brand new entirety of mortgage repayment whenever you are sending the fresh senior years membership benefits in order to any custodial facilities try staying her or him.