- Save very well notice costs when merging large focus bills. Yes, the best second financial can cause huge offers in the event the arranged properly and you may used for integration purposes truthfully.

- Beat payment number in order to raise your monthly chosen cashflow. A reliable agent could probably help you with figuring their prospective discounts.

- Invest that lump sum payment of money into home improvements that can assist improve value of your property.

- Use the next home loan money to include a rental product so you can your property which will make an additional income source.

- Next mortgage loans should be a powerful way to stay on finest of costs and you can mark the fresh new line with the slippery slope away from dropping into continuously financial obligation. You can use it financing to settle money owed so you’re able to assist in improving your credit score to be able so you can qualify for a far greater home loan service later on and you may replace your complete finances.

- Purchasing the money to your a business to create it develop or ensure that it it is running.

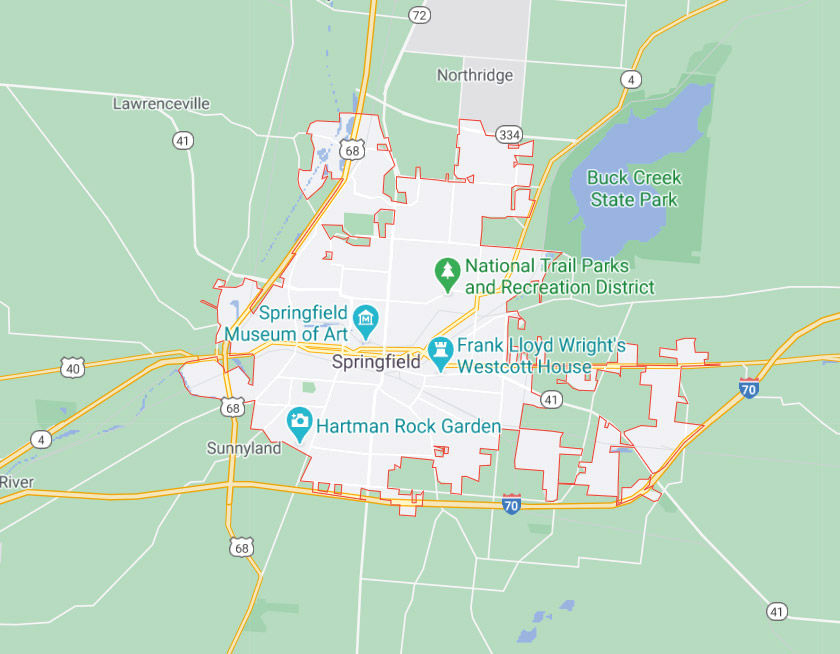

- If you’re in the or seemingly close to a primary urban area for example Toronto, your residence could possibly be eligible for a top loan-to-worth loan or even the reduced next financial costs.

You can discover more info on merging the debt with an extra mortgage or home equity mortgage within website entitled Ideas on how to Consolidate Your debt which have Bad credit

There are many different people who will benefit out of an extra financial, because there are several confident ways to use one minute home loan.

An extra mortgage can be a helpful tool when put smartly. It helps home owners get back on course economically, boost their credit score, and much more. If someone else has a corporate that may have fun with an increase from financing, 2nd mortgages can often become during the all the way down rates than simply traditional business loans. Let alone, that it’s notably more straightforward to get one minute mortgage than it is discover recognized having a corporate mortgage or team personal line of credit.

So long as you put in place the right kind of bundle in terms of settling your loan, second mortgage loans shall be a good short-label equipment used by property owners attain financial versatility and a lot more.

Exactly what are the downsides from second mortgage loans?

Inspite payday loans Meeker reviews of the self-confident gurus which come having a strategic 2nd financial, you can find naturally drawbacks that can are present or even arranged aside securely. A common drawback normally definitely through the highest interest rate and you will charges on the second home loan.

Other prospective fraud so you can taking right out an extra home loan is that when you yourself have a private bank financing who is funding brand new second home loan, then for folks who standard into one money the fresh new costs of the overlooked otherwise late costs is going to be significant. In the eventuality of default, some personal loan providers you’ll more quickly and aggressively push to take your home stamina regarding revenue.

The next financial can help individuals who have highest interest borrowing from the bank cards obligations, car and truck loans, figuratively speaking, personal loans, taxation arrears, or any other arrears repay their expenses less if you’re reducing specific of the cash flow challenges

In the eventuality of an electrical power off profit, private lender fees seem sensible easily plus one was kept with very little otherwise nevertheless in debt shortly after your home comes below stamina off business.

Due to this before taking out one minute mortgage, you need to make sure to get in touch with a specialist and you may search aside its viewpoint. A specialist large financial company will help provide you with the best training which help you make a robust and easy-to-go after package that can help you reputation your to have a better monetary coming. This really is a primary economic decision and you ought to verify you will get the best mortgage services that is available in order to your considering your position and wants.