With a house is similar to a feeling of identity and the ownership are sacrosanct. not, to invest in a home has been good Herculean activity now, courtesy this new rapidly expanding possessions prices. That it, in turn, leads to the elevated interest in mortgage brokers while they let your bring live the brand new dream about with a house. Simultaneously, it suits the requirements of homeowners out of different sections of community and have now brings along side benefits associated with taxation benefits towards the attention reduced plus the loan amount repaid. It bouquet regarding have helps to make the mortgage a favourable choices to have homeowners, particularly for people with minimal monetary capabilities.

There are a few celebrated banking institutions and you can NBFCs (Non-Financial Economic Features) that offer different kinds of home loans to buyers. These companies help the buyers when it comes to examining the fresh builder’s trustworthiness and tune suggestions and the courtroom records away from the building before they indication the deal. At the same time, they have put mortgage schemes having market markets. To quotation a few, you can find mortgage techniques for females, agriculturists, and loans simply for the acquisition from home, which makes it easier getting homeowners to get their dream become a reality.

If you’re this may have sure you about the need to get home financing, you happen to be curious what sort of home loan is appropriate to you personally. So you’re able to ideal, you will find signed up every requirements concerning the different types of mortgage brokers that you have to know regarding. Prior to bouncing toward types, let’s first know what try home financing and how will it functions?

What is home financing?

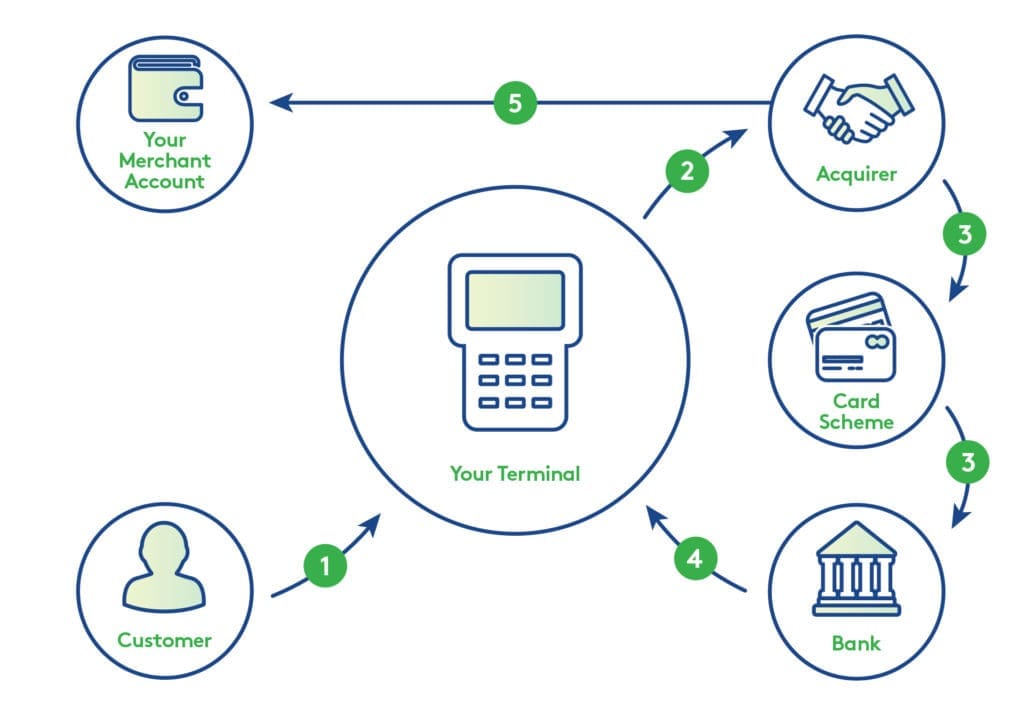

A home loan is an amount of cash that a single borrows from a bank and other standard bank in the an appartment interest rate and for a specific period. People generally get hold of finance for sometimes to acquire property/flat/belongings, design regarding a house otherwise recovery/expansion for the present household. This home is hypothecated on the bank while the a security right until this new repayment of the mortgage along with the focus and dominating matter when it comes to monthly EMIs.

On effective payment of one’s loan amount, the property is available in done ownership of borrower plus in matter of inability, its stated by the lender to recuperate the loan matter.

Different types of Mortgage brokers

Anybody sign up for a mortgage not merely for selecting a great domestic but also for some other causes. A few of the prominent brand of lenders is actually said lower than.

That loan toward purchase of belongings is actually for consumers to conserve loans and create a home once the cash ensure it is or have only the latest homes as an easy way off future financial support.

Mortgage To have Home Purchase

This is exactly the best types of lenders, delivered to buy a new or pre-possessed land, whether it’s another house otherwise a condo. The speed within this brand of financing are possibly fixed otherwise floating.

Mortgage To have Construction Off A property

People that already individual land and are generally likely to create good home look at this type of financial. The techniques requires into consideration the cost of land, but not, susceptible to the get within annually of loan application.

Financing Getting Family Extension Or Renovation

A special well-known choice certainly one of different kinds of lenders for home improvements particularly modifying current family design otherwise expansions including creating a new balcony/floor/place.

Loan For Family Conversion

Individuals who loans Aspen already bought a property about availed mortgage, however they are prepared to proceed to an alternative household can easily import the present day financing on the new home without the issues.