To have homeowners looking to have fun with its equity to pay off borrowing cards and other bills in place of dipping within their offers, this can be an attractive solution to lower its total cash advance Whatley Whatley, AL debt. 2nd, providing property equity financing regarding Hometap doesn’t effect your own credit score.

While your own credit are an issue inside determining qualification, disregard the director will get what they need versus and work out a challenging query on the borrowing. 3rd, you do not need a house assessment to close a great deal that have Hometap.

Finally, you will still live in your home and you may carry out anything you want to. Hometap does not get involved in household repairs otherwise recovery conclusion otherwise any aspects of functioning and you will keeping your family. As long as you continue home loan repayments, fees, and you will insurance rates newest, you won’t hear out of your Hometap financial support director up until it is nearing the payment time.

You also do not need Hometap’s consent to market your property, even when your offer will obligate one to posting the organization you to definitely youre promoting and to keep them apprised of the procedure.

Reasons to Be cautious. The Downsides Of using Hometap

As it is possible having any house guarantee investment solution, people is to carefully consider its problem and requirements to search for the best choice getting accessing the new security in their home. Hometap is actually a fairly simple way to achieve this, nevertheless may possibly not be right for the homeowners.

Limited Number of Metropolises

The first consideration is even though you live in new says where Hometap is signed up. The business can currently work on property owners into the:

- Arizona

- Ca

- Fl

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Nj-new jersey

- Ny

Thinking about Offering Inside Ten years

Its also wise to you should think about how much time you should will still be of your home. When you yourself have no intentions to circulate contained in this a decade, factors to consider you want how you will repay new financing within payment big date.

If you are Hometap doesn’t need which you sell your house, the final payment will pay Hometap its express of your well worth of your home. This can include the original investment in addition to consented-up on part of the rise throughout the residence’s well worth, which includes exceptions.

This might be a somewhat great deal of money, which could be protected by a funds-away refinance otherwise a traditional family collateral mortgage. Although not, if you cannot secure the rewards loans buying away Hometap’s share, Hometap is also make you offer your property to settle the fresh funding.

Less cash Than just A house Collateral Loan

Various other matter to look at is how far bucks you need. Hometap’s equity opportunities cover anything from five to help you 30 percent of the home’s security, that have an optimum commission out of $three hundred,100000. If you need extra money than you to, you could think a home collateral financing otherwise bucks-away financial refinance.

Domestic collateral finance normally allow home owners to view 80 in order to ninety percent of their home’s collateral. Such as for example, should your family enjoys a recent appraised value of $five-hundred,000 while are obligated to pay $three hundred,100000 in your financial, you’ve got $200,100000 for the collateral. A property collateral mortgage will give your access to as much as $180,100000 of the guarantee, while you are a Hometap collateral financial support perform simply give you a good maximum out of $60,000.

May end Up Costing Significantly more

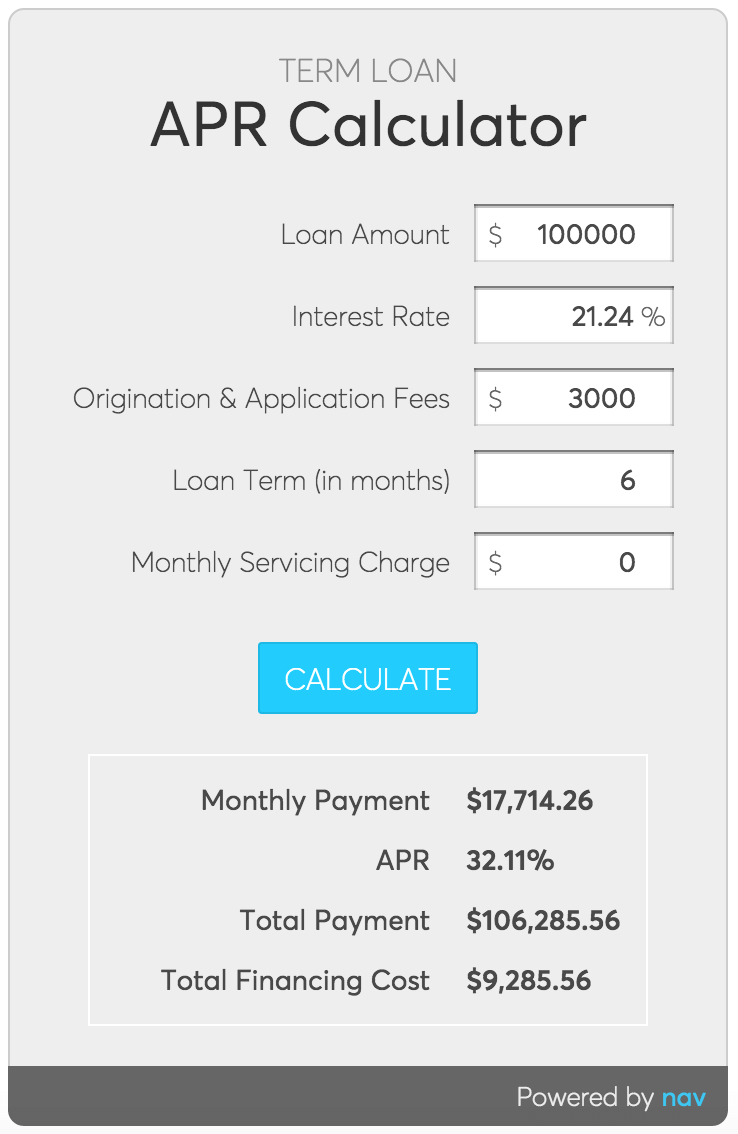

Such as, by using out an excellent $30,100000 home security loan into the an excellent $2 hundred,000 house during the mortgage of 5.6 percent, you are going to spend $39,230 across the 10-season title of these mortgage. That have a Hometap money, after a decade, you could potentially pay $fifty,000-$53,one hundred thousand, with regards to the specific regards to your investment deal. Which pricing huge difference could make a distinction to possess home owners who’re not holding extreme obligations that will qualify for a home equity financing.