Debt-to-earnings ratios it high dont be eligible for typical mortgages. HomeReady mortgages cap your debt-to-income ratio at the forty five per cent. It’s still you are able to become recognized for a financial loan in the event the you slide outside which limit, and additional earnings being gained by the other members of your children is one factor that you will persuade your own financial to agree their mortgage.

Co-Signer Income

Regarding HomeReady program, income away from non-tenant co-individuals (people whom sign the loan but not are now living in the home becoming purchased) is deemed for degree.

The fresh classic problem here’s you to mothers whom individual their homes can co-signal a mortgage making use of their children. Lenders often mix the money towards the chief borrower’s with regards to the loan.

Boarder & Roomie Earnings

Homeowners making an application for HomeReady mortgages can also play with boarder income to switch its qualification status. Whoever rents a space in your domestic qualifies as an effective boarder. To incorporate which money on other sources, you really must have paperwork appearing you to definitely local rental costs have been made during the last 1 year.

Boarder earnings may go quite a distance to your getting homeownership inside the learn. Bear in mind, you really need to make sure that your roommate/boarder can transfer to the fresh home immediately following you buy it. If they manage, their rental income should be a asset into the being qualified for and buying your own mortgage!

When you are looking to pick a property that already keeps accommodations room built into it, (such as for instance, a basements flat, a moms and dad-in-laws product, or any other attachment systems) the potential local rental earnings away from you to definitely equipment could help qualify to have a great HomeReady mortgage.

You can utilize brand new advised money from a supplementary device inside the the new degree techniques even if you dont but really features good roomie otherwise tenant lined up. That means that this new a dozen-month mutual house background required for boarder/roomie earnings isn’t needed right here.

Their prospective house have to be classified due to the fact a-1-device house or apartment with a keen ADU rather than a multi-unit house. When this is true, you can use local rental money to be eligible for their financial without people landlord experience otherwise training. Whenever you are to order a property having 2 or more systems, it may be it is possible to to make use of rental income, but it is probably be that lender may wish to look for training otherwise feel you to definitely aids the viability once the a landlord.

Money Limits Toward HomeReady Mortgages

Discover limits on allowable debtor earnings to own HomeReady mortgage loans one are different according to located area of the family getting ordered. The reason for the cash restrictions is always to make sure the assistance available with the HomeReady system would go to individuals who really are interested. Here is an introduction to the funds guidelines:

- No income limitation applies to qualities based in reasonable-income census tracts

- Debtor money is bound so you can 100% of area’s median money for the appointed disaster elements and you will higher-fraction components

- Borrower money is restricted so you’re able to 100% of the area’s median income in every other areas

The payday loan South Van Horn following is an elementary example of the money constraints work. State a buyer wants a property in La County. Los Angeles’ average earnings is currently $67,2 hundred. If for example the customer renders lower than it, she will be eligible for a great HomeReady home loan to your any assets in your neighborhood. If she makes over new median earnings, an excellent HomeReady financial perform simply be readily available in the event that she sought out a home in the an underserved area where in fact the program’s earnings limitations dont use.

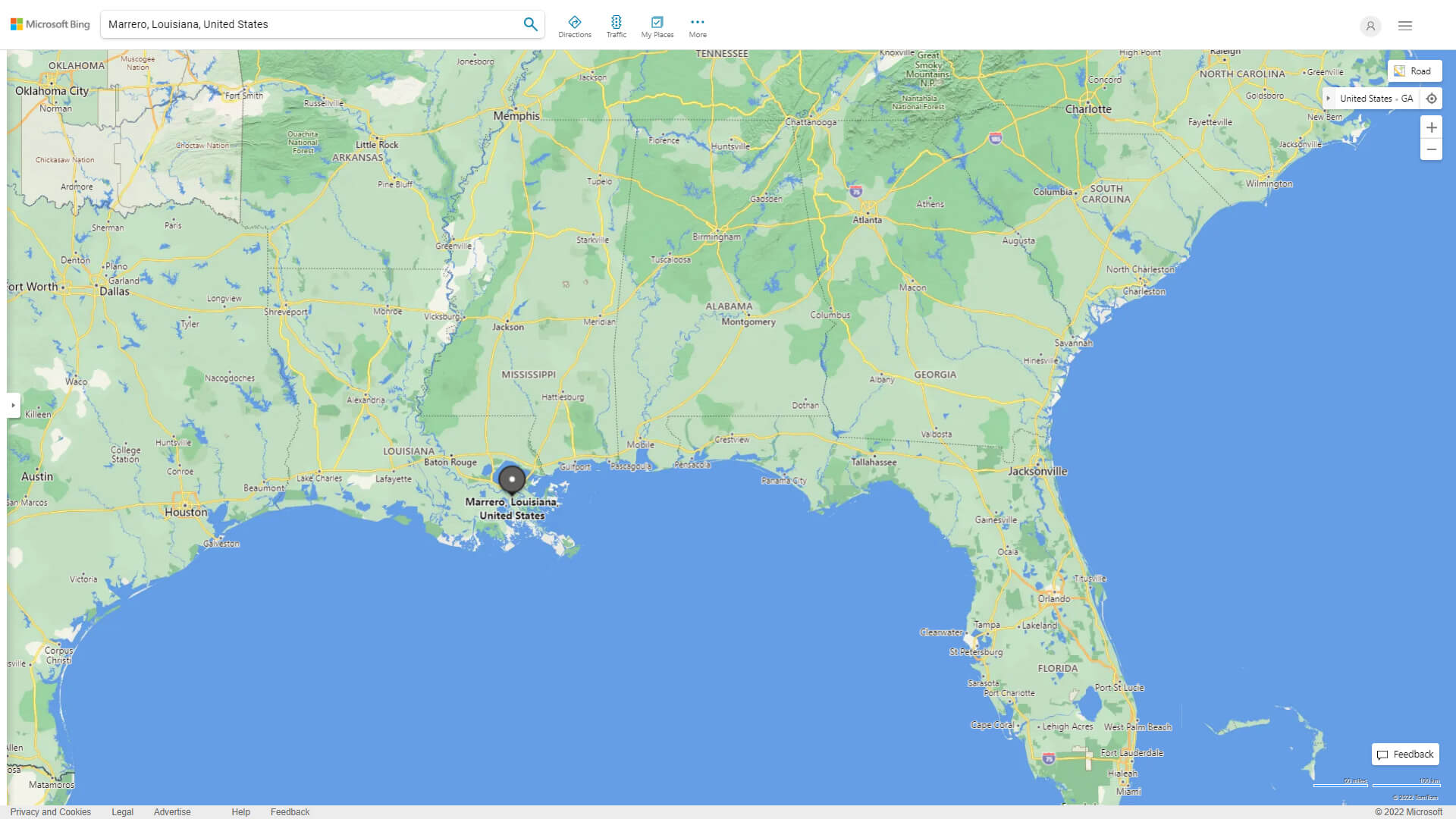

HomeReady qualification would be dependent on referring to this new qualifications maps Fannie Mae features wrote for every condition. The specific borders are often tough to come across; you will want to confer with your financial to the particular target of every assets you see to shop for to verify its qualifications and money maximum inside.