- Renovating your home can be very fulfilling.

- Money is the key.

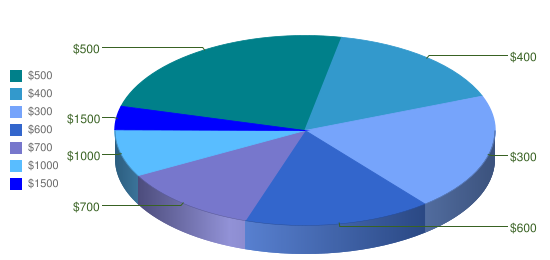

- A property renovation loan try less expensive than commercially ready loans.

- Other advantages of a home repair mortgage are

- tax professionals

- less processing

- very easy to get

- flexible utilize

A property isn’t only regarding a roof over your head. Its a lot more than simply one. You reside your pleasure, highlighting the updates and fulfillment. Its a pleasure to reside a beautiful family. Aesthetics and you will comfort number around their home’s venue and you can structure top quality. The condition and surroundings in your home produces the latest much crucial first effect on the mind of customers. Help your house be a representation of your character. You no longer require to go to till it can save you adequate financing so you can upgrade your residence toward specifications, you can take advantage of a home restoration loan.

You can get a house restoration mortgage to change, refurbish or upgrade your house. The top advantage of a house renovation mortgage is that they allows you to change your current where you can find a modern build and you can a warmer liveable space, customized depending on your likes and artistic choice. This type of finance are like a house loan. When you find yourself a mortgage gives you acquire a house, domestic renovation funds try designed for increasing the family that you already own.

Why should you choose a property recovery mortgage?

Even though there is actually many ways for which you normally financing the house restoration, household restoration funds has a number of advantages that produce them attractive. Here’s a peek.

Lower rates of interest:

Although you will get get a consumer loan for the intended purpose of your house restoration, the interest with the like a loan is typically higher because this is a personal bank loan. A home ree pricing while the home financing, therefore it is a stylish choice since it is secure facing your owning a home.

Taxation benefit:

A house repair loan fetches you a taxation benefit on the focus role, that’s, you can avail a deduction all the way to Rs. 31,000 per annum (lower than section 24) into appeal which you pay during these financing. This deduction away from Rs. 31,000 is in the total limit away from Rs. dos Lakh available on financing interest percentage regarding notice-filled home. Put another way, focus money towards the home buy and domestic renovation finance build qualify for a good deduction as much as Rs. dos lakh. The brand new Rs. 30,000 deduction could cause a tax saving of up to Rs. 10,three hundred thus cutting your total cost away from credit.

Restricted documents:

Home recovery fund include relatively easy documents when comparing to most other methods regarding money. You just need earliest documents such as for instance term / earnings evidence, photo, possessions title-deed, etc. If you’re a preexisting consumer of the property finance company (you have taken a home loan on bank), the newest records becomes smoother.

Small handling:

Domestic recovery fund are processed rapidly due to the fact paperwork is actually limited and you may stress-totally free. So you can get their renovation functions already been on very first rather than an extended wait a little for your loan app getting accepted.

In the House Restoration Financing

Family Repair Money is actually versatile, hassle-100 % free and the lowest-cost technique of and make your home a much warmer life style put. Certain secret regions of a property restoration loan try:

Self-reliance in usage:

You can also utilize your property repair mortgage to possess various issues in your home including repair, solutions, floors, expansion, decorate an such online payday loans Colorado like. This basically means, you need to use your loan finance for really works that pertains to your framework in your home. You simply cannot but not use it getting resolve otherwise purchase of movable items like chairs, fittings, furniture an such like.

Eligibility:

It is possible to apply personally otherwise as one to have choosing so it financing. Should your house is as one owned, all people who own the property need to fundamentally apply for the home reily participants could become mutual candidates into the financing also if they are perhaps not shared people who own our house.

Features:

The borrowed funds period shall be doing 15 years. The real tenure would depend on your profile how old you are within readiness away from loan, age your home assets, your income, etc. The speed is typically just like the house loan interest. Interest rates could be varying (floating) across the period of your own financing otherwise fixed to possess a selected several months. Lenders constantly offer present people up to 100% of its renovation imagine susceptible to a specified ceiling to your market value of your property. New customers can get not end up being supplied a lowered percentage of the estimate, once more at the mercy of brand new limits to the property value.

Data called for:

- Duly filled application

completion

Having your domestic renovated doesn’t only improve the electricity out-of your property, also uplift your morale and provide you with brand new satisfaction regarding proudly showcasing your residence in order to relatives and buddies. Method of getting hassle-totally free house restoration fund eliminates the brand new financing constraint which are often stopping you moving forward for making your house exactly that little more liveable and you may likeable. The fresh new taxation deductions that can come in addition to this mortgage increase the pros. Proceed; promote your house the design that the cardiovascular system desires.