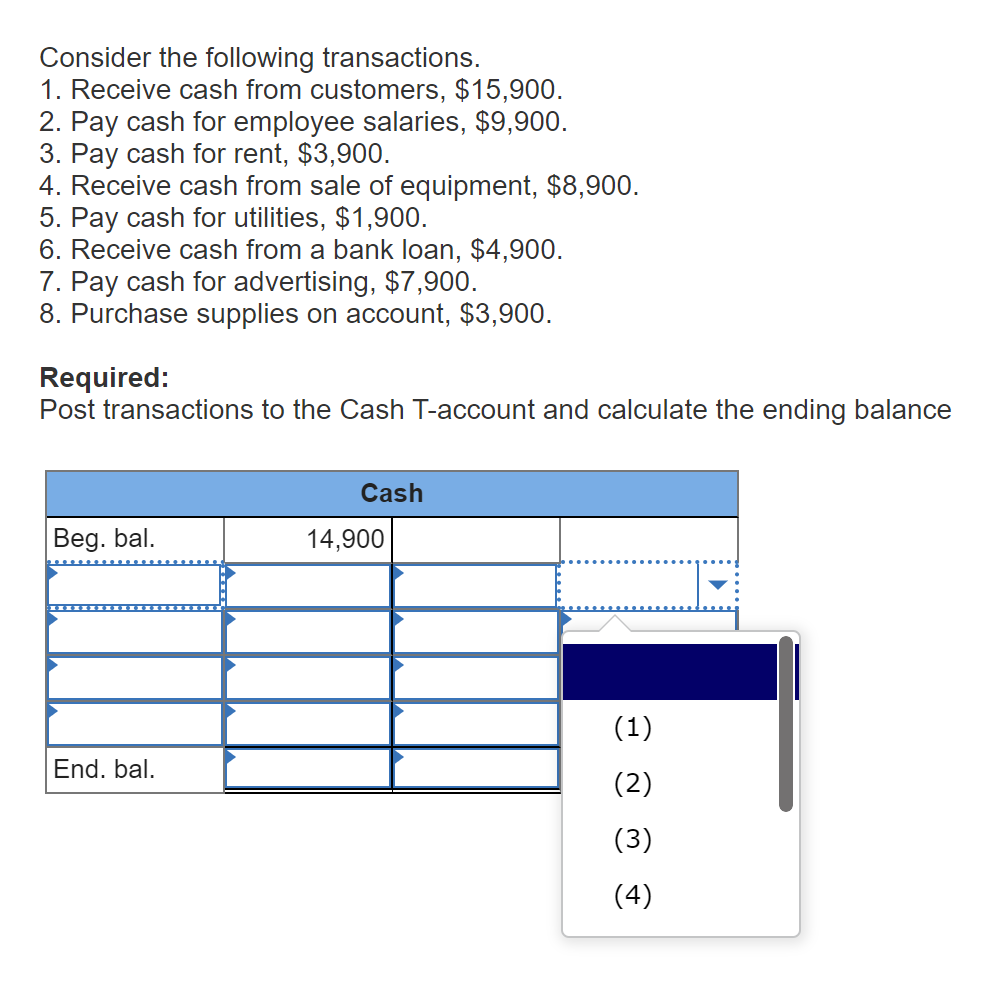

Yet not, FICO — the absolute most commonly used credit scoring institution — really does upload what kinds of data it takes into account, and exactly how far it weighs in at for each grounds.

- Fee record (35% of score)

- Numbers owed (30% off get)

- Credit history length (15% away from rating)

- Credit mix (10% from score)

- The newest borrowing (10% out-of get)

- Do you really pay-all your debts timely every month? (Fee record)

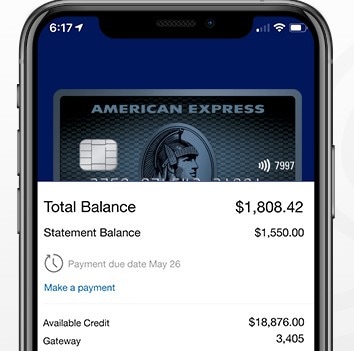

- Are you presently maxing out your playing cards? (Number due)

- Are you experiencing a very good reputation of trying to repay loans? (Credit rating length; earlier is advisable)

- Do you have the skills to cope with many sorts of debt? (Credit combine)

- Maybe you’ve removed multiple the brand new loans, handmade cards, and other forms of credit recently? (The brand new borrowing)

What is my borrowing from the bank application rate?

Whenever businesses are choosing your credit score, it contrast how much cash you borrowed to exactly how much borrowing your have available. It’s your borrowing from the bank utilization price. They issues towards the “Amounts Owed” sounding credit history.

FICO discusses utilization across the all your valuable handmade cards, but it addittionally takes into account private cards. To have a good credit score, keep your own credit utilization at about 30% otherwise smaller for each cards.

Just like the lower use is better, cutting it generally increases your credit score. After you pay off personal credit card debt plus score goes upwards, you might credit most of one to increase to that particular a consideration.

If you are next to maxing your playing cards, your credit rating could plunge 10 points or higher once you pay back bank card balances completely.

If you haven’t used most of your available borrowing, you could potentially only gain a number of situations once you pay credit card debt. Yes, even though you pay off this new cards entirely.

Because your use ‘s the ratio of most recent credit card balances on the mastercard constraints, it’s important to maintain your playing cards unlock. $0 owed to your a card having a beneficial $step one,000 limitation is impressive. $0 due if you have zero handmade cards cannot pack the exact same punch.

How much time right after paying regarding playing cards do credit history raise?

Their mastercard issuer typically delivers an upgraded report to borrowing bureaus once a month if your statement months stops. A unique credit rating try determined each and every time your own credit are removed, therefore the brand new get spends the equilibrium recommendations. So you should see the consequence of these payments as soon since your balances change on your credit file.

As to the reasons did my personal credit rating go lower when i paid down my bank card?

When your credit history falls once you pay back an excellent credit card, its generally speaking as you finalized your bank account. Why? Once again, they boils down to usage.

Borrowing from the bank application minimizes when you repay mastercard balance. However, so it simply work if the total readily available borrowing remains new same.

When you romantic credit cards, you reduce access to that personal line of credit. It means the total available borrowing from the bank decrease. When you yourself have balance in your left handmade cards, a reduction in the overall offered credit can lead to the usage speed to go up.

To cease so it, pay off mastercard balance instead of closing your membership. Of course, for those who have difficulties with your cards sensibly — or the card has an annual fee — it can be useful to close off the brand new account, inspite of the potential influence on your get.

Shorter personal debt, best results — it’s a profit-win

It is usually best if americash loans Blountsville you pay-off credit card debt month-to-month, regardless of what you to debt fees has an effect on their fico scores. If you don’t keeps an intro Annual percentage rate price, people an excellent equilibrium transmitted from month to month accrues appeal — at the a leading interest.