Taking home financing in the Asia is fairly effortless but it might be an expensive affair. But not, there’s a silver lining to it, and is various taxation advantages one can possibly rating every season in it, as per the conditions of one’s Income tax Work, from 1961. Which Operate include individuals sections around hence additional home loan tax experts is provisioned for financial consumers to avail.

A home financing has a couple of factors: fees of your own dominating share plus the attract payments. Fortunately, these be eligible for income tax deductions. When you’re dominating payment are deductible lower than Part 80C, deduction towards attract fee was greeting not as much as Point 24(b) of the Income tax Act, 1961. Read on knowing tips acquire the interest for the property mortgage deduction to possess ay 2023-24.

Taxation Masters to the Lenders

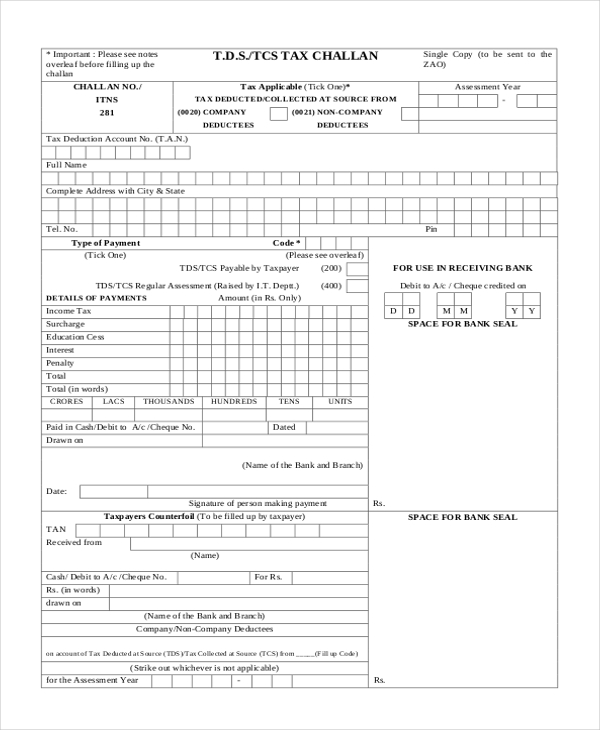

The following table suggests the annual tax benefits in more chapters of the funds Tax Act, away from 1961, showing the house loan focus tax deduction and you can housing mortgage attract different.

This mortgage need to be approved (birth 01.4.2016 and finish 29.step 3.2017). The loan amount is actually below or equivalent to ?thirty-five lakh plus the worth of property cannot surpass Rs. ?50 lakh.

Point 80C: Taxation Advantages to your Payment of the property Financing Dominating Matter

A home loan debtor was allowed to allege taxation experts up in order to ?1,50,000 towards the dominant payment regarding his/their unique taxable earnings, on a yearly basis. It work with are going to be stated both for leasing and you will care about-occupied qualities.

- So you’re able to claim benefit not as much as so it part, the house or property by which the loan might have been lent might be completely based.

- Extra taxation benefit of ?step one,50,000 is also claimed not as much as it part for stamp obligations and you can membership fees; however, it could be reported only if, we.age., at the time of this type of expenses obtain.

- A great deduction allege can not be made if your same property is marketed within 5 years from possession.

- In this situation, one said deduction is corrected around away from selling. In addition, it sum might possibly be as part of the individuals money into season, where the home is marketed.

Significantly less than Point 24(b), an excellent taxpayer normally allege a deduction to your focus repaid on the the house mortgage. In this situation,

- One could allege a beneficial deduction on the attention paid with the home mortgage to have a personal-filled family. Maximum taxation deduction greeting is up to up to ?dos,00,000 in the terrible yearly money.

- However if a person is the owner of several property, after that in this case, the newest combined income tax allege deduction for lenders try not to surpass ?dos,00,000 for the a financial year.

- In the event your domestic might have been rented away, then there’s zero limit about how far it’s possible to allege to your notice repaid. This consists of the complete quantity of attract paid with the home financing to your pick, construction/repair, and payday loans Connecticut you may renewal otherwise resolve.

- In the eventuality of loss, you can allege an excellent deduction out-of just ?dos,00,000 within the a financial 12 months, given that remainder of the allege will likely be sent pass to possess a tenure away from 7 decades.

Around Area 24(b), an individual can and allege a great deduction to your rate of interest if the property purchased is actually not as much as design, because the structure is completed. It area of the Work allows states on the both pre-framework and post-construction period attention.

Section 80EE: More Deductions to the Interest

- Which deduction are said on condition that the expense of brand new household received will not exceed ?50 lakh and loan amount can be ?thirty-five lacs.