Think about : Whether or not your credit rating is lower than 580, you may still qualify for an FHA Mortgage, your down payment criteria could be high. In such a case, a good 10% downpayment could be $20,000 for the very same $two hundred,000 family.

Sharing your specific financial predicament which have a mortgage lender, such as for instance DSLD Home loan, is definitely a good idea to talk about all of your current selection and you can find the best mortgage program to match your requires and you will budget.

The debt-to-income ratio (DTI) is another crucial factor in determining their qualifications for a keen FHA Financing in Colorado. Put differently, DTI was an evaluation of monthly loans money on the disgusting month-to-month money. It helps lenders evaluate your capability to deal with your financial obligation when you find yourself trying out a new mortgage.

FHA Financing standards when you look at the Colorado generally support an excellent DTI out-of doing 43% , although some freedom can be found, and in particular times, a DTI as much as 50% may be appropriate. It indicates your overall monthly loans payments, including your proposed homeloan payment, must not exceed 43% (or possibly fifty%) of your gross month-to-month income.

In the event your newest DTI exceeds the fresh welcome restriction, discover things to do to improve it. These could include settling existing bills, boosting your earnings, otherwise investigating financing choices having straight down monthly premiums. By the strategically dealing with your DTI, you could potentially raise your probability of being qualified to own an FHA Loan and protecting a less expensive mortgage.

FHA Financing Criteria from inside the Tx: Property Criteria

Outside of the economic certification, FHA Finance inside the Tx also provide certain criteria to the property itself. First of all, the home you buy with an FHA Mortgage must be your first home. It indicates you intend to inhabit the home since your principal house in place of utilizing it because a residential property otherwise travel house.

Before you could intimate in your new house, it will need to endure an appraisal by an enthusiastic FHA-acknowledged appraiser. This appraisal means the new house’s really worth aligns for the mortgage amount and this matches the brand new FHA’s lowest possessions standards.

These standards are created to make sure the home is safer, structurally sound, and you will suits basic livability standards. Whilst not exhaustive, they safety issue such as the house’s foundation, rooftop, electricity program, plumbing, and you will complete position. The target is to be certain that you happen to be committing to a property you to definitely isn’t just an audio monetary decision and also a safe and you will comfortable spot to label home.

FHA Loan Standards for the Texas: Money and you will A career

Together with your credit rating and you may advance payment, FHA Mortgage standards during the Texas contemplate your revenue and you will a position records. Lenders have to make certain what you can do to repay the loan, therefore you can easily generally have to give proof income from the brand of latest pay stubs, W-2s, or tax statements.

Balance is vital with regards to a job. FHA loan providers generally prefer borrowers who have been constantly employed for at the least 24 months, although exclusions can be made for these that have a strong performs record and reliable earnings offer.

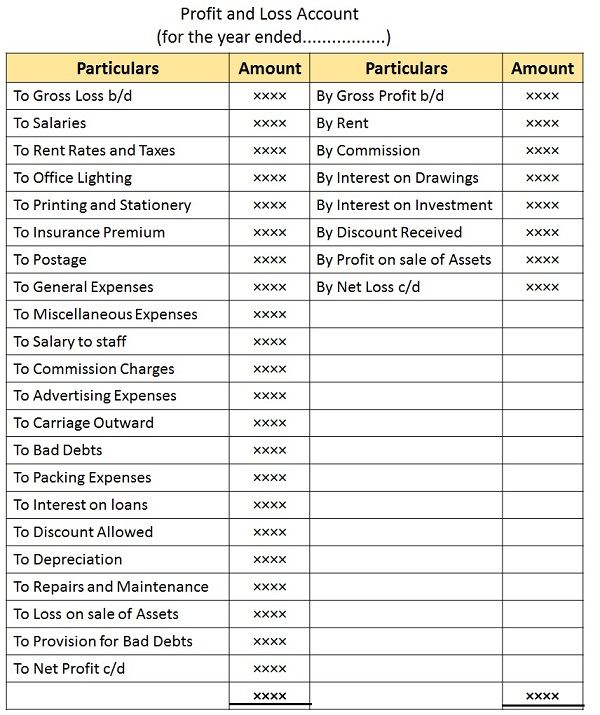

While self-operating, the newest FHA Mortgage requirements during the Colorado might need extra documentation so you’re able to make sure your payday loans New Castle revenue. This may are profit-and-loss comments, balance sheets, and other financial ideas appearing your organizations earnings as well as your element and make uniform mortgage payments.

FHA Financing Requirements inside the Texas: Financial Insurance rates (MIP)

Mortgage insurance fees (MIP) was an elementary requirement for FHA Funds in the Texas. This insurance coverage covers the lending company in the event the borrower defaults toward the mortgage. If you are MIP adds an extra cost for the month-to-month homeloan payment, in addition, it can make FHA Financing more accessible by permitting to own straight down off money and credit rating conditions.