Running operations with obsolete and less efficient assets has many significant competitive disadvantages, including increased costs, limited production and customers dissatisfaction etc. A modernization project is not a classification used to describe capital projects. However, expansion projects and new products and services projects are classifications that are used. A manufacturing company is contemplating buying a new machine that would automate one portion of its production process. This machine would cost $1 million to purchase and install, but it is expected to save the company $200,000 per year in labor costs. The availability of funds obviously affects project choices, and smaller companies tend to have more capital constraints.

- Throughput analysis looks at the entire company as a sign profit-generating system, with the throughput being the measured amount of materials going through the system.

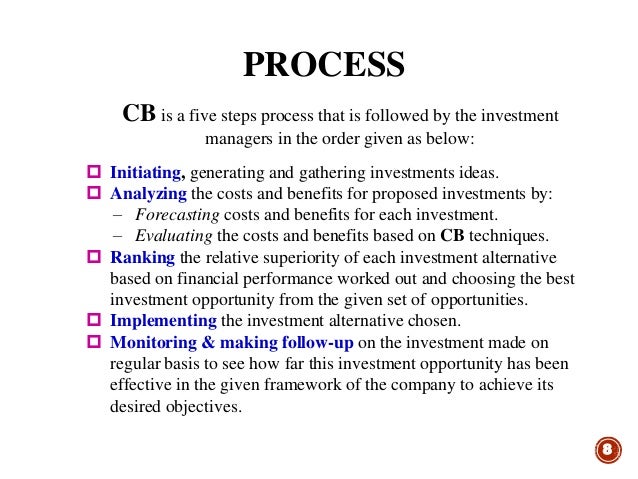

- Capital asset management requires a lot of money; therefore, before making such investments, they must do capital budgeting to ensure that the investment will procure profits for the company.

- Mobile technologies enable stakeholders to access project information and make decisions from any location.

Key Takeaways

ProjectManager is online project management software that connects teams in the office, out in the field or even at home. They can share files, comment at the task level and much more to foster greater collaboration. It’ll establish the feasibility of the project in technical, financial, market and operational ways. The following example has a payback period of four years, which is worse than that of the previous example, but the large $15,000,000 cash inflow occurring in year five is ignored for the purposes of this metric.

Evaluating the project

Capital budgeting may be performed using any of the methods above, though zero-based budgets are most appropriate for new endeavors. U.S. Treasury bonds have risk-free rates as they are guaranteed by the U.S. government, making it as safe as it gets. The mechanism for transitioning from a budgeted item to an approved project for execution is the Capital Expenditure Request (CER) or Authorization for Expenditure (AFE) Request. It’s these CapEx Requests that are typically subjected to delegation of authority approval prior to project setup and procurement activities officially commencing. The access security and integrity of manually prepared and exchanged spreadsheets is inherently compromized.

Payback period

Establish effective communication channels and collaboration protocols between different departments involved in project implementation. Ensure alignment of objectives and activities across all participating teams and stakeholders. Let’s explore the key reasons why this systematic approach is indispensable in modern financial management. This means getting quotes for purchases and finding a way to pay for the project.

Gathering information and making cash flow estimates

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. These proposals, along with ranks, are sent to the Capital Expenditure Planning Committee (CEPC) for consideration. Further to the last point, careful management must select those proposals with greater profitability. This enables them to maximize shareholder wealth, which is the basic objective of each company. In particular, the amount invested in fixed assets should ideally not be locked up in capital goods, which may have a far-reaching effect on the success or failure of an enterprise. Thus, it is a process of deciding whether or not to commit resources to a project whose benefit would be spread over the years.

Integration with accounting software

These reports are not required to be disclosed to the public, and they are mainly used to support management’s strategic decision making. Though companies are not required to prepare capital budgets, they are an integral part in planning and the long-term success of companies. There are other drawbacks to the payback method that include the possibility that cash investments might be needed at different stages of the project. If the asset’s life does not extend much beyond the payback period, then there might not be enough time to generate profits from the project.

Specific project management software helps a great deal in capital budgeting and is great for reviews and the monitoring of progress. There are also investment analysis tools that can be explicitly used to gain insight into potential returns. Many teams are already harnessing the power of AI for project what are pre tax payroll deductions and benefits cost management, too. By analyzing potential investment decisions through a strict process, businesses can ensure they make decisions that align with their long-term plans. If their goal is to be number one in their industry, capital budgeting can help them invest in projects with that goal in mind.

Throughput analysis looks at the entire company as a sign profit-generating system, with the throughput being the measured amount of materials going through the system. Another major advantage of using the payback period is that it is easy to calculate once the cash flow forecasts have been established. Capital budgeting is the long-term financial plan for larger financial outlays. Although it considers the time value of money, it is one of the complicated methods. However, the payback method has some limitations, one of them being that it ignores the opportunity cost.

Before taking on huge investments, business owners need to consider potential upcoming changes to labor regulations and the financial implications these might have. For instance, if there were changes to overtime payments for non-exempt vs exempt employees, there would be an impact on profits. It is a way of measuring potential risks against the expected return on investment. Decision-makers use this to analyze investments of equipment to expansions and takeovers.

This integration eliminates the need for manual data transfer, reduces reconciliation efforts, and maintains consistency in financial records while streamlining the overall accounting process. Mobile technologies enable stakeholders to access project information and make decisions from any location. These systems can automatically import data from various sources, validate information against predefined parameters, and flag potential discrepancies while maintaining consistent data formats across projects. The process establishes monitoring frameworks for tracking project progress against planned timelines and budgets.