There’s absolutely no magic to finding an educated interest rates for house guarantee fund. These prices try had written and you may up-to-date weekly. They are available online at of several monetary other sites work because of the financial institutions, advice people, financial enterprises and you may financial reporting companies. Initiate your search at reputable other sites such Bankrate otherwise CNBC getting latest financial factual statements about rates. Fo…

Better House Security Financing Speed – Get the best Family Collateral Speed

Finding the optimum home guarantee financing speed seems fairly easy. You only research rates at advertising and select the lower number, proper? Incorrect. That’s far too easy! The stated price might be numerous one thing. It is an advertised price, but it may possibly not be the pace which you personally qualify to own. It may be the easy interest rate and not the fresh compounded Annual percentage rate (annual percentage rate) interest rate. T…

Ideal Financial Financial Refinance – How to Get the best Home loan Financial Refinance Rates?

Who does not require to get a decreased rates on their mortgage home mortgage refinance loan? It is possible to assure that you can aquire an informed re-finance real estate loan rates. Are a money movie director is a sure way to reside Piedra loans one to will always be bring in financial advantages such as for instance straight down interest levels getting fund. The manner in which you spend your finances and you may manage your credit accounts is actually reflected in your credit file you to details your own …

Finest Loan Shielded – Bad credit Most readily useful Mortgage? Covered!

Probably the worst credit score tend to rating you financing whenever you may have one thing useful so you’re able to safer it with. As opposed to unsecured loans, that are supplied based on credit rating and centered available on a contract to repay, secured personal loans was secured by the concrete possessions that provide lenders collateral against the amount borrowed though borrowers default. For folks who don?t repay brand new secured loan considering …

Finest Home mortgage Rate – How to get an informed loan price with the home financing

Anyone who is actually to invest in a house otherwise refinancing a fantastic home loan knows well the problem off locking into the a rate. Readily available mortgage cost fluctuate wildly from lender so you’re able to bank, including on a monthly basis whether your government decides to change the interest rate. Of a lot refinancing marketing one to checked practical otherwise indeed too-good so you can shun was found are considering faulty presumptions a keen…

Best Refinance Mortgage loan Financing Rate – Will there be a sole Re-finance Real estate loan Financing Price?

What individuals need to comprehend regarding the refinancing prices is because they are very different depending on standards of one’s debtor and you will stipulations because of the financial. There are various items that go into undertaking a good refinancing rates; funds are very personalized each user. There is absolutely no blanket mortgage, and there is zero blanket most readily useful mortgage rate of interest. A knowledgeable refinance mortgage mortgage rates about eyes off…

Bristol Real estate loan – Real estate loan to own Bristol, RI

While looking for a real estate loan into the Bristol, RI, there are some what to consider and watch for that are of importance so you’re able to property owners where town. Mortgage rates are like across the country averages for the Bristol, RI. Insurance policies are a tiny large, due to latest ton. Having ton insurance policies for your house from inside the Bristol is an excellent requirement. Mortgage averages all over the country now try v…

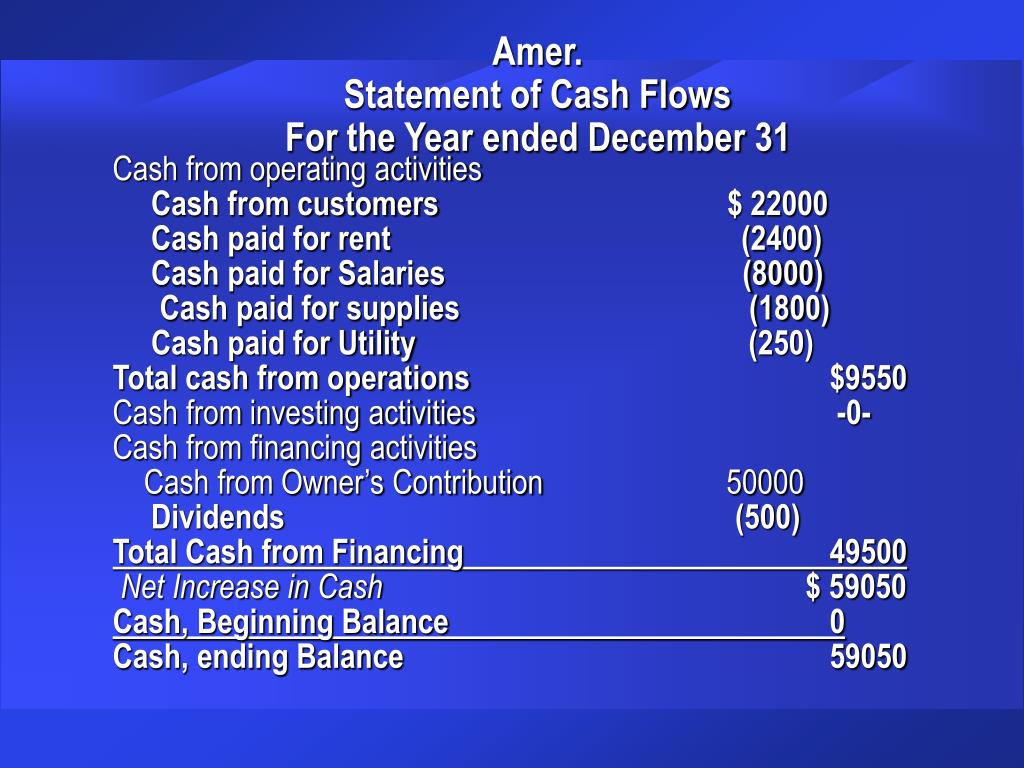

Calculator Security Financial – How House Collateral Financing Hand calculators Helps you

Making use of the brand new collateral of your home is going to be a handy and value-efficient way to get into currency to own higher expenditures particularly home improvements or educational costs. Of numerous home owners enjoys an abundance of equity readily available, the eye costs and you will monthly payments with the family collateral finance are apparently lowest and the attract to your financing is oftentimes income tax allowable. House security ‘s the difference in your home?s curren…